|

A lot of HR people talk about the importance of welcoming someone into the organization. Orientation and onboarding are critical to the new employee experience. Much less time is spent supporting and reflecting with the exiting employee. Most exit interviews focus solely on the transactional details of benefits continuation and returning company property. Perhaps you may ask what someone enjoyed or didn’t enjoy about the company, or what qualities to look for in a successor. If a position is being eliminated or a person is being terminated for performance, the exit becomes even more difficult. Regardless of the reason for exit, treat the person with courtesy and respect.

When an employee is leaving your organization, give them an opportunity to reflect on his positive contributions and what he has learned / gained. In addition to the standard questions, consider adding a few more:

If the person leads a team, add a few additional questions:

Any person exiting or entering your organization can be a brand ambassador. When someone departs for their next adventure they don’t stop caring. Do everything you can to make their exit as pleasant as their entrance. Greetings Roo friends and fans,

We wanted to provide an update regarding the COVID-19 related Payroll Protection Program (PPP). Many thanks to Propel Nonprofits, the Minnesota Council of Nonprofits and Sunrise Banks for providing the source data for this post. Who is eligible?

How much money is available and how can it be used?

Which staff members are included?

Loan forgiveness Provisions

Stay strong friends! Hello Roo friends and fans.

We learned good news today! It was originally thought that employers would have to foot the bill for the new Emergency Paid Sick Leave (PSL) and Emergency Family Medical Leave Act provisions (EFMLA) and await reimbursement. We learned today that employers will be allowed withhold normal payroll tax remittances to the IRS to cover the costs of the new paid time off requirements. Scenarios:

Also, here is a link to the new required posting relative to the new COVID-19 related paid time off requirements: https://www.dol.gov/sites/dolgov/files/WHD/posters/FFCRA_Poster_WH1422_Non-Federal.pdf Roo will be working hard to keep you apprised of this rapidly changing landscape, without flooding your inbox unnecessarily. Many thanks, and stay healthy! We are all reeling with new ways of working, public closures and social distancing. Even though you may feel like you are focused on Coronavirus 24/7, Roo wanted to make sure you are aware of new required paid time off requirements related to COVID-19 that were signed into law March 18th. These new time off requirements are effective April 2, 2020. We will also briefly address filing for unemployment.

1. Emergency Paid Sick Leave

The FMLA has temporarily been expanded to include “public health emergency leave”, specifically related to COVID-19. “Normally”, FMLA applies only to employers with 50 or more employees within a 75-mile radius. The Emergency Family and Medical Leave Expansion Act (EFMLEA) applies to all employers with 500 employees or less for COVID-19 related absences. It is our understanding that “regular” FMLA still only applies to organizations with 50 + employees in a 75-mile radius. If our understanding changes, we will let you know.

If YOU have been permanently, or temporarily laid off, or if your hours have been significantly reduced, you may apply for unemployment benefits. The 5-day waiting period has been eliminated, so you may receive benefits immediately. If eligible, you may receive up to 50% of your normal wage, to a maximum of $740 / week. https://www.uimn.org/applicants/needtoknow/news-updates/covid-19.jsp There is also good news for SMALL BUSINESS OWNERS - you may also apply for unemployment, and the five-week limitation has been removed. Any layoffs due to coronavirus will not be charged to the employer UI account. https://www.uimn.org/applicants/affectsbenefits/ownership/index.jsp For the SELF-EMPLOYED , it is possible, but unlikely, that you can claim unemployment benefits. Your chances are better if you opted into the unemployment insurance pool. https://www.uimn.org/applicants/affectsbenefits/self-employment/index.jsp Please do reach out by phone (763-228-8496) or email ([email protected]) if we can help. As we wind down 2019 with friends and family, it is also time to look ahead to 2020. Roo is here to help you get a jump start on your HR initiatives with simple, sustainable solutions. So what’s on your HR Wish List?

Give us a shout if we can help…….and be sure to read to the bottom for some important compliance reminders. HR Wish List Training and Development □ Supervisory Training: Stepping into Leadership □ #metoo and you – preventing workplace harassment □ Project Management □ Link to other Roo Solutions workshops Capacity Building / HR Infrastructure □ “HR in a Box” – for the small employer with no HR systems in place □ Update job descriptions □ Creation of interview guides for commonly staffed positions □ Onboarding program development □ Recruiting assistance Culture □ Employee Surveys □ Climate Assessments □ Making organizational values actionable □ Workplace Investigations Risk Mitigation □ HR Audit □ Employee Handbook update □ Supervisory Handbook Compliance – Must Do’s! □ 1/1/20 New minimum wage in MN. Download your new required poster here □ Provide MN-required wage statement to new employees, and notify employees when there is a change to their employment status (promotion, raise, etc.) □ Ensure employees are classified correctly as exempt or nonexempt under the 1/1/20 new FLSA regulations. The new salary threshold is $35,568. The duties test in unchanged □ Minneapolis employers. You must provide all employees with the MN wage statement. In addition, Minneapolis requires the employer to state how SST is accrued and how a “year” is measured. SST used and accrued must also be listed on each pay stub. Happy (almost) New Year! During the course of my career I have had the benefit of working for some great organizations. Organizations that took the time to identify their core values, embed them into all HR systems, and hire/fire/promote according them. For those working in the nonprofit sector it is easy understand and actively promote the mission and values of your organization. For those in the for profit world, or at an individual level in any industry, it can become a little trickier to understand how these values impact our daily work. For values to have meaning we must make them actionable.

If your organization hasn't identified core values, here is a way to derive them.

Organizational Value: Entrepreneurship Behavioral Statements:

Here is another example: Organizational Value: Service above self Behavioral statements:

This is neither a quick or easy process. It cannot be delegated to a project team. It takes focused attention and many hours for the leadership team to get it right, but it is worth the effort. Be sure to validate your thoughts with key employees before rolling this out to the entire organization. Reinforce organizational values through HR systems. As mentioned above, if something is really a core value, the organization is will to make sacrifices to live up to that value. That includes the people we have working in our organizations. How can you embed core values into everyday behaviors?

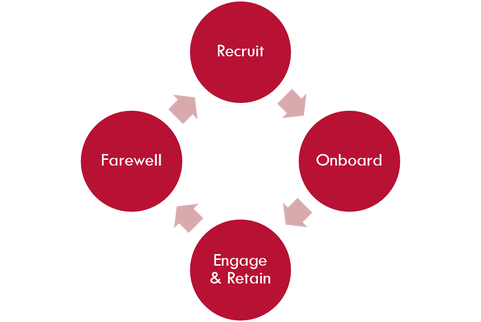

For more on organizational values read Patrick Lencioni’s “The Advantage”, Gino Wickman’s “Traction”, or give Roo a call. We’d love to work with you. As Roo gears up for the Minnesota Council of Nonprofits Annual Conference in Rochester October 24 - 25, I was reminded of the opportunity I had to engage with participants across the region during an e-learning event offered earlier this year (thank you for inviting me to participate!). There was great engagement surrounding the topic of how your HR practices can help or hinder your success as an organization at every stage in the employment life cycle.

Despite the snowy view outside my window, spring is here. This is a great time for your employees and supervisory to fine tune their work skills. 3 of Roo’s training programs are highlighted below. Reach out to Roo if you want to talk about these programs or other needs.

Stepping into Leadership During this 8-week series of 90-minute sessions you supervisors will learn, share, and practice key supervisory skills in a supportive environment that reflect your company values. Timing between sessions allows for your supervisors to practice the skills developed and debrief at the next session. For clients outside of the Twin Cities, topics can be covered in two half-day or one full day session. Topics include;

#metoo and you If you have not conducted harassment prevention and workplace expectations training within the past two years, the time is now! Admittedly, most harassment prevention trainings are quite boring and focus on “thou shalt nots”. This is an effective CYA approach, but today’s environment provides the context for much richer dialogue in your organization. Part history lesson and part current events, this interactive training will engage your staff in relevant discussions regarding healthy workplace behaviors. Real World Diversity, Equity and Inclusion Diversity, Equity and Inclusion is all the rage, but how does this actually show up in your organization? We will enhance awareness of our own identities and biases, dig deeper into the privilege that isn’t visible, and provide tools to help staff build their confidence with cross-cultural communications. Does the hashtag #METOO inspire hope, curiosity or concern for your organization?

It is hard to believe it has only been one year since the Harvey Weinstein allegations began the avalanche of investigations into sexual harassment across multiple industries. While we often think of sexual harassment as a Mad Men-era issue, harassment of all kinds is unfortunately alive and well. If you have not conducted harassment prevention and workplace civility training within the past two years, the time is now! Admittedly, most harassment prevention trainings are quite boring and focus on “thou shalt nots”. This is an effective CYA approach, but today’s environment provides the context for much richer dialogue in your organization. Below are a few suggestions to liven up your training, and to engage your staff in robust conversation.

|

From Roo to you!